TDS On Insurance Commission (Section 194D)

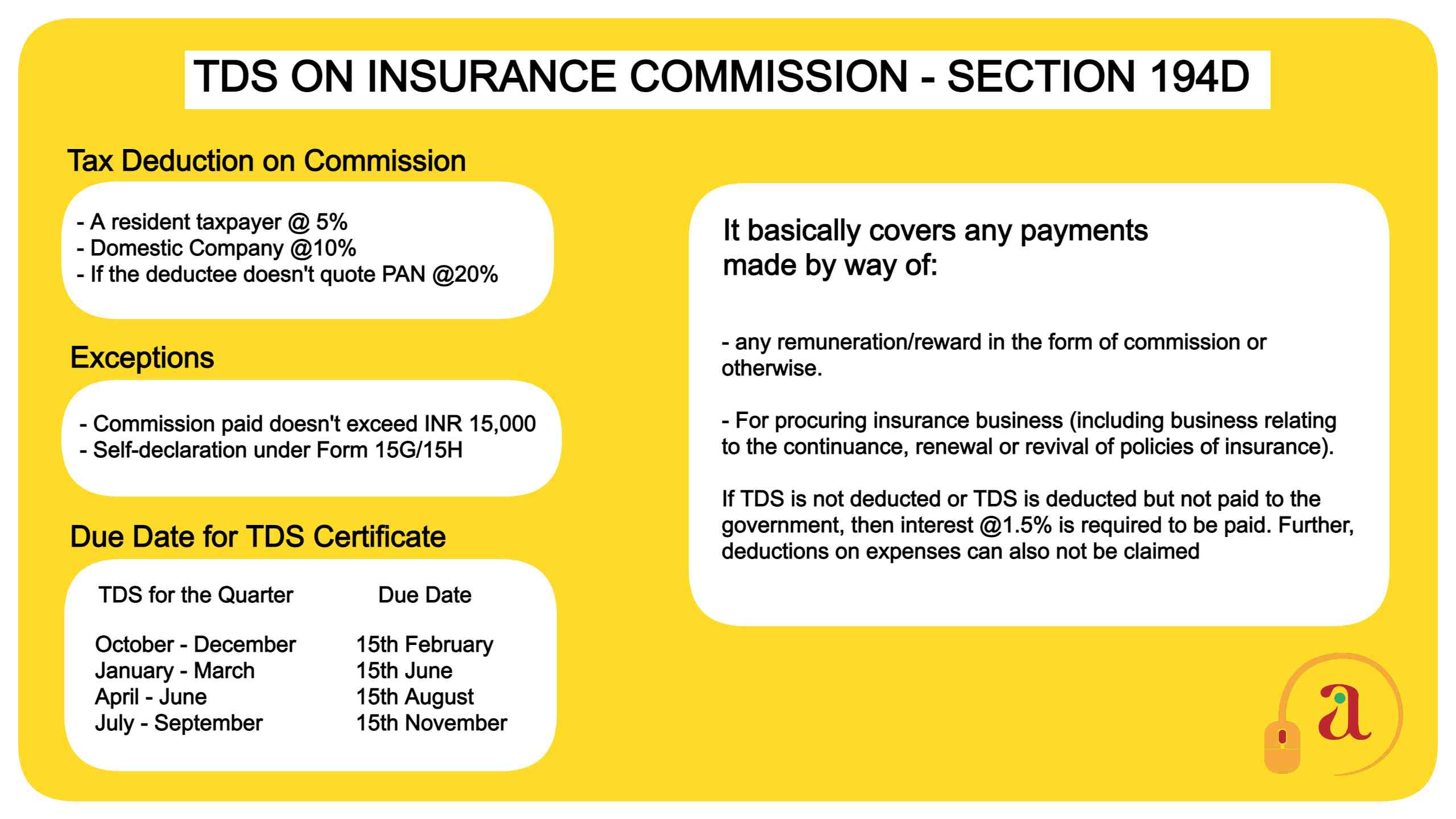

TDS under Section 194D is to be deducted in case any person who pays to resident an income in form of remuneration/reward for generating insurance business.

When you buy an insurance policy through an agent, he receives commission, remuneration or reward. Such commission, remuneration or reward attracts TDS under Section 194D of the Income Tax Act

👉Click Here to File You TDS Return👈

Cases Where TDS Is Deducted Under Section 194D

The cases where TDS is deducted under Section 194D, as stated above is on the payment to resident person in form of remuneration/rewards by way of:

– Commission

– Soliciting or obtaining insurance business

– Continuance, renewal or revival of policies of insurance

Instances Where TDS Is Not Deducted Under Section 194D

There are two instances, where TDS is not liable to be deducted under Section 194D:

– Commission paid does not exceed Rs. 15,000

– Self declaration under Form 15G/15H

When Is TDS Deducted Under Section 194D?

The TDS on Insurance Commission under Section 194D is deducted on the following events, whichever is earlier:

– At the time of credit of commission in the account of the payee, or

– At the time payment is made in cash or cheque or kind

Rate Of TDS Under Section 194D

Particulars | PAN is furnished | PAN is not furnished |

Persons other than a company | 5% | 20% |

Domestic company | 10% | 20% |

Note:

Surcharge or Secondary and Higher Education Cess is not to be added in the above TDS rates.

Non-Deduction Of TDS Or Lower Rate Of Tax Deduction

An individual who receives a commission can make an application in Form 13 to the Assessing Officer for a certificate authorizing the payer not to deduct tax or to deduct tax at a lower rate.

In accordance with section 206AA(4), no certificate under Section 197 for non-deduction or lowered rate of deduction will not be given unless the application also provides the PAN of the applicant.

Time Limit To Deposit TDS Under Section 194D

The due date to collect and deposit tax deducted on commission paid to insurance agents is 7th of next month.

Due Dates For Issuing TDS Certificates

After the TDS has been deposited by the person responsible for deducting TDS, the payee/recipient will get TDS Certificate. This certificate summarizes the insurance commission, reward or remuneration payments and TDS thereon. The due dates for issuing TDS Certificates are as follows:

Months | Due Date |

April – June | 15th August |

July-September | 15th November |

October-December | 15th February |

January – March | 15th June |

Consequences Of Non-Compliances

Levy of Interest: If the person responsible for deducting TDS, does not deduct the TDS on insurance commission or deducts the TDS but does not deposit to the government, then interest @1.5% is required to be paid on such amount.

Disallowance of expenses: Also, such person is not eligible to claim the deduction of expense from Profit and Gains from Business & Profession income, if TDS is not deducted on time.