Share on Social 👇

Taxability Of Capital Assets In India – All You Need To Know

Many people own capital asset but are not aware of the taxability. In this article, we shall explain in detail about the taxability of capital asset in India.

What Are Capital Assets?

The Capital Assets are specifically defined under Section 2(14) of the Income Tax Act specially defines capital assets. As per this definition, it means

- Property of any kind held by an assessee

- Securities recognized by SEBI, held be a Foreign Institutional Investor

- ULIPs to which exemption under Section 10(10D) does not apply

- Urban agricultural land

Test To Determine Capital Assets

In order to determine whether something is a capital asset or not, it should not be any of the following:

- Any stock-in-trade, consumables or raw material held for the purpose of business of profession

- Any personal effects such as movable property – wearing apparel and furniture held for personal use by the assessee or his family members

- Rural agricultural land

- 6½% gold bonds gold bonds (1977) or 7% gold bonds (1980) or national defence gold bonds (1980) issued by the central government

- Special bearer bonds (1991)

- Gold deposit bond issued under the gold deposit scheme (1999) or deposit certificates issued under the Gold Monetisation Scheme, 2015

Types Of A Capital Asset

A Capital Asset can be of two types:

- Long Term

- Short Term

- Long Term Capital Asset: An asset whose holding period is more than 12/24/36 months, depending on the type of asset is a long term capital asset.

- Short Term Capital Asset: On the other hand, an asset whose holding period is less than 12/24/36 months, depending on the type of asset is a short term capital asset.

Duration Of A Capital Asset

The duration of a capital asset depends on the type of asset, which is as follows:

Capital Asset | Long Term Duration | Short Term Duration |

Immovable property (eg: Land) | More than 24 months | Less than 24 months |

Movable property (eg: Jewellery) | More than 36 months | Less than 36 months |

Shares recognised by SEBI | More than 12 months | Less than 12 months |

Unlisted Shares | More than 24 months | Less than 24 months |

Equity Oriented Mutual Funds | More than 12 months | Less than 12 months |

Debt Oriented Mutual Funds | More than 36 months | Less than 36 months |

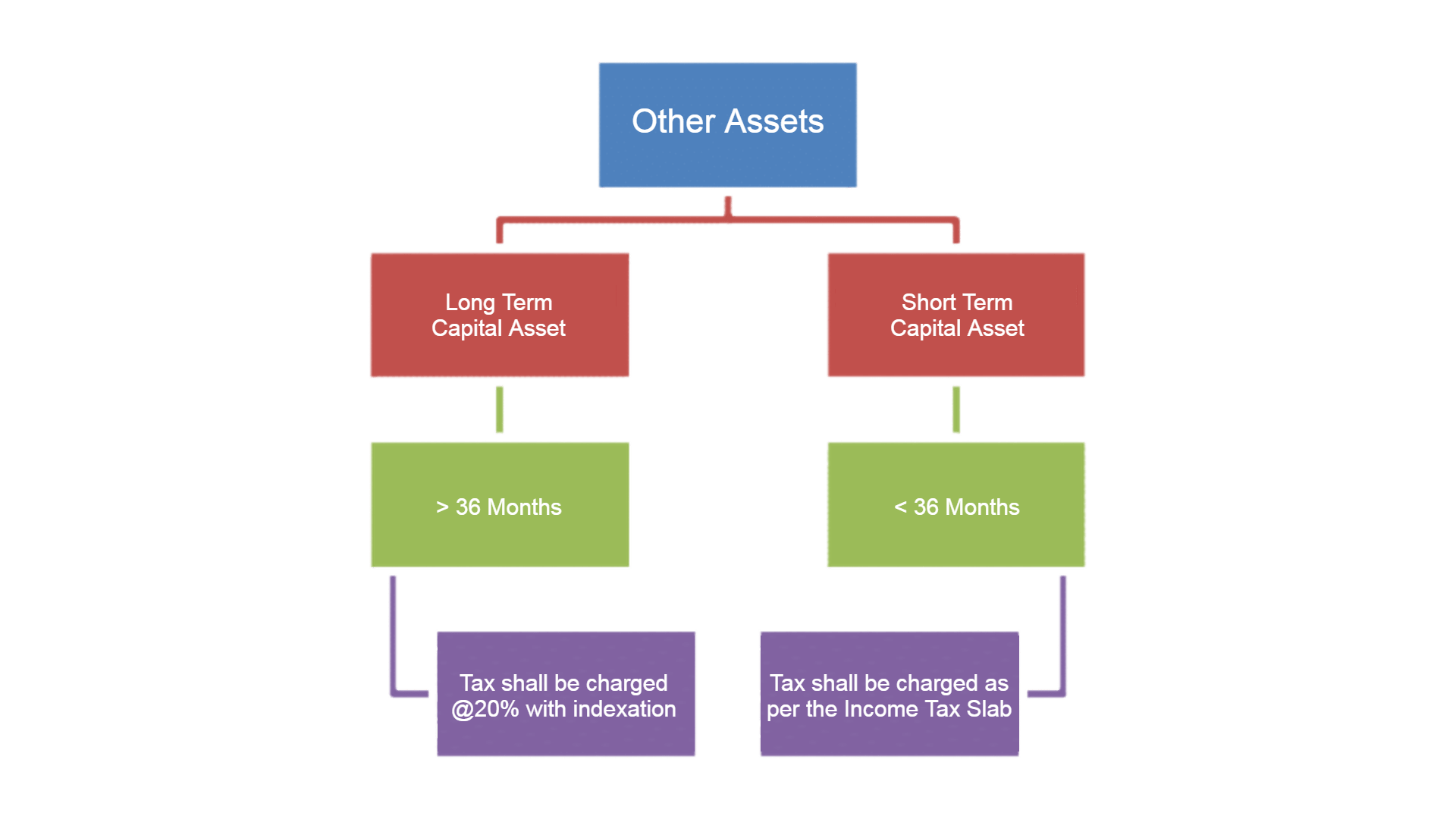

Other Assets | More than 36 months | Less than 36 months |

Examples Of Capital Assets:

Shares

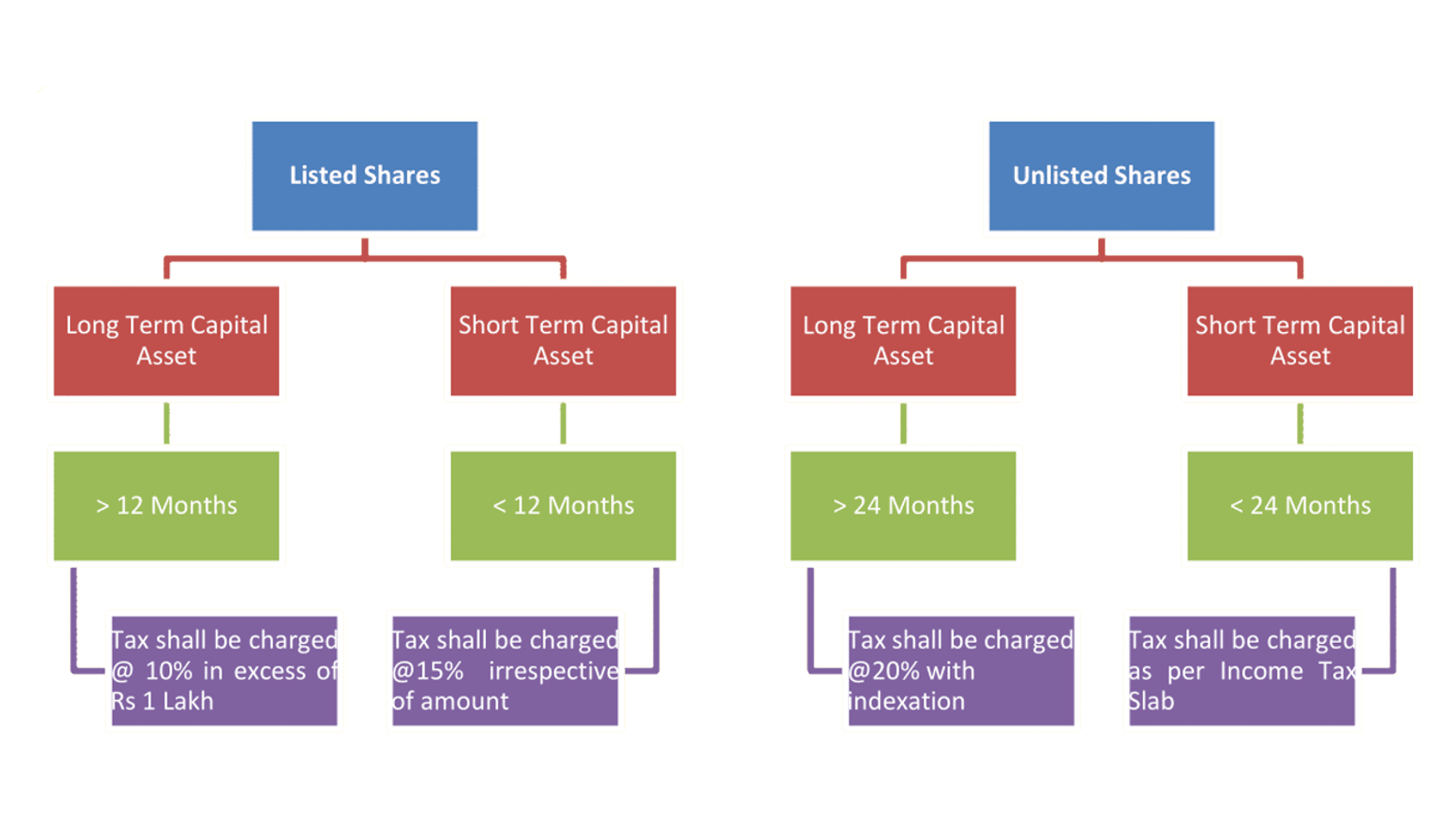

If the assessee holds the shares for trading purposes, then it is not treated as a capital asset. However, if he holds these shares for non-trading purposes, then it is treated as a capital asset. Further, the stocks are divided into two parts:

- Listed Shares

- Unlisted Shares

The taxability on the sale of shares on the basis of type and duration are as follows:

Mutual Funds

Mutual funds being movable property are capital assets. The mutual funds are of types:

- Equity Oriented Mutual Funds (investment in equities is more than 65% of the total portfolio)

- Debt Oriented Mutual Funds (investment in equities is less than 65% of the total portfolio)

The taxability of these types of mutual funds and is dependent on the duration of holding. Moreover, it is as follows:

| Funds | w.e.f 11 Jul, 2014 | On or before 10 Jul, 2014 | ||

| Long Term Capital Gains | Short Term Capital Gains | Long Term Capital Gains | Short Term Capital Gains | |

| Equity oriented Funds | Tax shall be charged @10% in excess of Rs 1 Lakh | Tax shall be charged @15% irrespective of amount | NIL | Tax shall be charged @15% irrespective of amount |

| Debt Oriented Funds | Tax shall be charged @20% with indexation | Tax shall be charged as per Income Tax slab | 10% without indexation or 20% with indexation whichever is lower | Tax shall be charged as per the Income Tax Slab |

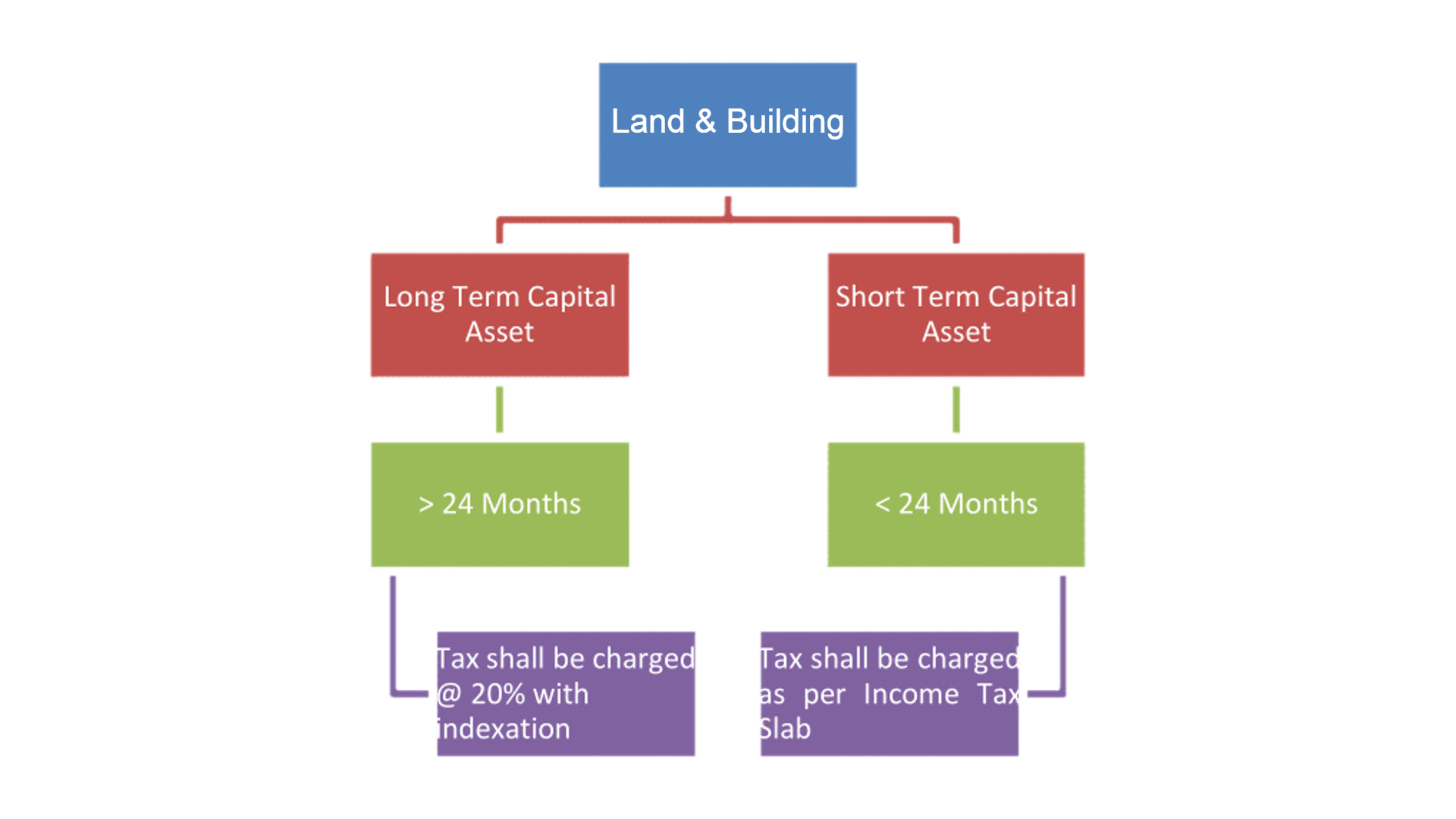

Land & Building

Land & building is a property which is also a capital asset and the profit on sale of such land and building is a capital gain. Moreover, the taxability rates on the basis of duration are as follows:

Cars

Car is a capital asset if it is used for business purposes because it allows in the purpose of depreciation. On the other hand, car purchased for personal purposes is not considered to be a capital asset.

Jewellery

Jewellery like gold, silver, diamond, precious stones, etc. are also capital assets. Consequently, any profit made on sale of it is treated as capital gain.

Some Other Examples Of Capital Assets:

Art and Collectibles

Till 31st March, 2007, art and collectibles was not considered to be a capital asset. However, from 1st April, 2007 the gain is no longer tax-free since the definition of capital asset has been amended to include paintings, sculptures, drawings, archaeological collections or any work of art.

Business Assets

With respect to assets that are used for the purpose of business, tax payers are allowed to claim depreciation on the cost of acquisition of such assets. In addition, the depreciation, under the income tax laws, for such assets is allowed, on the basis of a concept called ‘block of assets’. The profit (Sale price – Written down value) on sale of such asset will be taxed as business income under the head “Profits or Gains from Business or Profession”. Therefore, it is considered as a capital asset and profit on sale of such asset is capital gain.

Cryptocurrency

The cryptocurrency is a property held by the assessee. Earlier, there was no provision for taxing of the virtual currencies. But through the budget of 2022, the cryptocurrencies shall be taxable at 30%.

Thereby, a new section namely Section 115BBH(1) was inserted in the Income Tax Act.

Furthermore, post April 1, 2022, both short term and long term virtual digital currency will be taxed at flat 30%. This is applicable even if the income from digital asset is treated under the head income from business or profession or income from other sources.

Conclusion

Capital Asset | Immovable Property |

Long Term Duration | More than 24 months |

Short Term Duration | Less than 24 months |

Long Term Tax Rate | Tax shall be charged @20% with indexation |

Short Term Tax Rate | Tax shall be charged as per Income Tax Slab |

Capital Asset | Movable Property |

Long Term Duration | More than 36 months |

Short Term Duration | Less than 36 months |

Long Term Tax Rate | Tax shall be charged @20% with indexation |

Short Term Tax Rate | Tax shall be charged as per Income Tax Slab |

Capital Asset | Listed Shares

|

Long Term Duration | More than 12 months |

Short Term Duration | Less than 12 months |

Long Term Tax Rate | Tax shall be charged @10% in excess of ₹1 lac |

Short Term Tax Rate | Tax shall be charged @15% irrespective of amount |

Capital Asset | Unlisted Shares |

Long Term Duration | More than 24 months |

Short Term Duration | Less than 24 months |

Long Term Tax Rate | Tax shall be charged @20% with indexation |

Short Term Tax Rate | Tax shall be charged as per Income Tax Slab |

Capital Asset | Equity Oriented Mutual Funds |

Long Term Duration | More than 12 months |

Short Term Duration | Less than 12 months |

Long Term Tax Rate | Tax shall be charged @10% in excess of ₹1 lac |

Short Term Tax Rate | Tax shall be charged @15% irrespective of amount |

Capital Asset | Debt Oriented Mutual Funds |

Long Term Duration | More than 36 months |

Short Term Duration | Less than 36 months |

Long Term Tax Rate | Tax shall be charged @20% with indexation |

Short Term Tax Rate | Tax shall be charged as per Income Tax Slab |

Consult a C.A

Got a query? Talk to a Chartered Accountant. Click on the button 👉