National Pension Scheme 80CCD(1B) – How To Claim ?

Section 80CCD(1B) of the Income Tax Act deals with the deductions provided to individuals contributing to the National Pension Scheme (NPS).

What Is Section 80CCD(1B) Or NPS?

Through the Union Budget, 2015 a new section namely Section 80CCD(1B) was inserted in Income Tax Act. This Section offers an additional deduction of Rs. 50,000 over and above the deduction of Rs. 1,50,000 under Section 80C.

Having stated that, NPS or National Pension Scheme is a pension scheme which is available to both government employees and private citizens. In other words, the contributions to NPS can be made by any major individual in India. Further, the investment in NPS can be done by the individual till he is working and then, on retirement, the corpus can be availed in form of annuities.

Tax Deductions Available Under Section 80CCD (1B)

The benefits of tax deductions under Section 80CCD(1B) is in addition to deduction of Rs. 1.5 lacs under Section 80C. Through Section 80CCD(1B), an additional deduction of Rs. 50,000 can be availed during each financial year. They can split their NPS contribution and claim partly in 80C and remaining in 80CCD(1B), making the most of Rs. 2 lakhs of tax deduction. Here’s a look at NPS tax benefits:

Particulars | Section | Maximum Deduction | Note |

Self Contribution to NPS | 80CCD(1B) | Rs. 50,000 | In addition to Section 80C and Section 80CCD(2) |

👉 Read About: Section 80C Deductions: Available Even Without Any Investment!

How To Claim Section 80CCD(1B)?

The deduction of Section 80CCD(1B) can be claimed by opening and investing NPS Tier-I Account. Having stated this, the amount contributed by the individual can be claimed as deduction under Section 80CCD(1B) at the time of filing of Income Tax Return.

Eligibility To Invest In National Pension Scheme

Investment in National Pension Scheme can be done by Resident Individuals as well as NRI. The age of the investor should be between 18 – 60 years.

👉 Read About: TDS On Insurance Commission (Section 194D)

Types Of NPS Account To Claim Deduction Under Section 80CCD(1B)

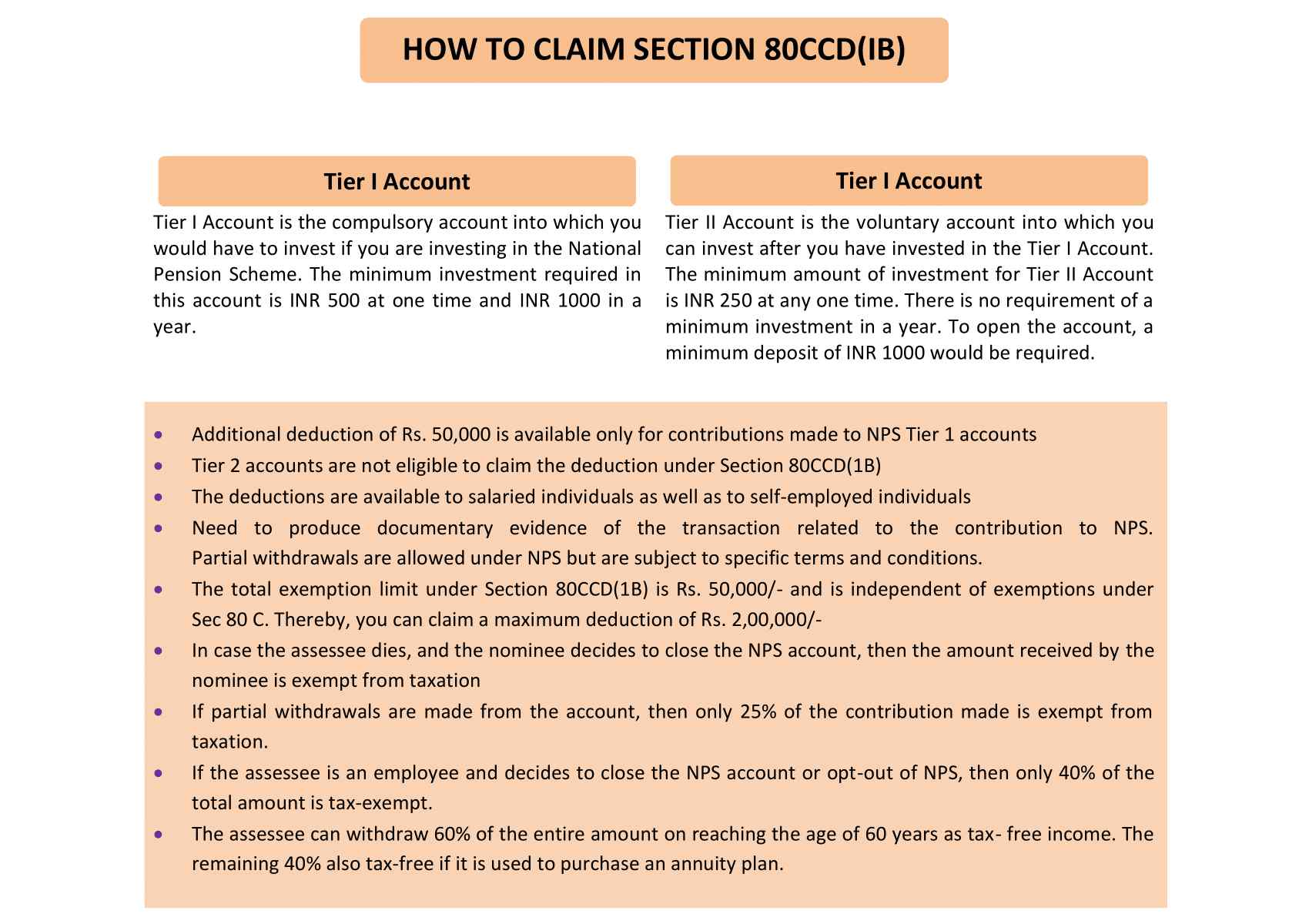

To claim deduction under Section 80CCD(1B), there are two types of accounts under NPS:

NPS Tier-I Account | NPS Tier-II Account |

It is a retirement basis account which is mandatory to avail NPS tax benefits | It is a voluntary account which can be opened only if there is existing NPS Tier-I Account |

It can be opened by any Indian citizen – Resident or Non Resident aged between 18-60 years | It can be opened only by member of NPS Tier-I account holder |

Minimum amount to be invested is Rs. 500/- | Minimum amount to be invested is Rs. 1,000/- |

It is mandatory to invest every year | It is not mandatory to invest every year. |

Generally, withdrawal is done at the age of 60 years | Withdrawal can be done at any point of time |

The amount is tax free under Section 80CCD(1), Section 80CCD(2) and Section 80CCD(1B) | There is no deduction available apart from the contributions made by the government employees under Section 80C of Rs. 1.50 lacs |

How To Invest In National Pension Scheme Section 80CCD(1B)?

National Pension Scheme Section 80CCD(1B) investment can be through a financial institution, which acts as Point of Presence (POP). In India, almost all the financial institutions are authorised to act as POP. These institutions have specialised branches to collect NPS deposits from the proposed investors.

Documents Required For Opening Account For National Pension Scheme Section 80CCD(1B)

The documents required for opening account for National Pension Scheme Section 80CCD(1B) are as follows:

- NPS Registration form,

- Identity proof

- Age proof

- Address proof

👉 Read About: Can You Claim HRA Even If You Own A House?

Withdrawal From National Pension Scheme

National Pension Scheme matures when the individual attains 60 years of age. Withdrawals from the National Pension Scheme before this age would be subject to certain terms and conditions. These terms and conditions apply to investments done in Tier I Account. In Tier II Account, withdrawals are allowed without any restrictions. Withdrawals can be of two types:

- Full withdrawal

- Partial withdrawal

Full withdrawal

The individual can close the National Pension Scheme investment before attaining 60 years of age. When he does so, 20% of the accumulated corpus can be availed in lump sum and the remaining 80% is used for paying annuities. 20% of the lump sum withdrawn is allowed as a tax-free income. The annuity payments are, however, taxable in your hands.

Partial withdrawals

Partial withdrawals are allowed after two years have been completed of investing in the National Pension Scheme. Furthermore, up to 25% of the accumulated funds can be withdrawn. Withdrawals are allowed only for meeting specified expenses like marriage expenses, medical emergencies, financing a home, etc.

Up to three partial withdrawals can be done during the investment period of the scheme and between each withdrawal, there should be a gap of 5 years. The amount of partial withdrawal is allowed as a tax-free benefit.

👉 Read About: Capital Gains On Sale Of House – All You Need To Know

Maturity Of The National Pension Scheme

When the individual attains 60 years of age, the scheme matures. On maturity, 60% of the accumulated corpus can be taken in a lump sum. Annuity payments would then be made from the remaining 40% of the corpus. The lump sum benefit would be tax-free in individual’s hands and the annuity payments that he receives would be taxed as per his income tax slab rates.

Important Points Related To Section 80CCD(1B)

- The returns under the NPS are directly related to the market performance but the return from this scheme is highest in the market. This is so because the National Pension Scheme is backed by the government

- The additional deduction of Rs. 50,000 is available only for contributions made to NPS Tier-I Account

- No deduction can be claimed under Section CCD(1B) for making contributions in NPS Tier-II Account

- The deductions under Section 80CCD(1B) are available to salaried individuals as wells as self employed individuals

- In case the assessee dies, and the nominee decides to close the NPS Account, then the amount received by the nominee is free from tax