Link Your PAN with Aadhaar before 31.3.2023.

Due Dates For Linking Aadhaar With PAN

As per Income-tax Act, 1961, it is mandatory for all PAN holders, who do not fall under the exempt category, to link their PAN with Aadhaar before 31.3.2023.

From 1.04.2023, the unlinked PAN shall become inoperative.

Link it before it’s too late. Don’t delay, link it today!

SO HURRY UP!

Cases Where Linking Of Aadhaar With PAN Is Not Required

The linking of Aadhaar with PAN is not required in the cases if the individual is either

– A residing in the states of Jammu & Kashmir, Assam, and Meghalaya, or

– A non-resident as per the Income Tax Act, 1961, or

– Of the age 80 years or more at any time during the previous year, or

– Is not a citizen of India

Late Fees Applicable On Linking Aadhaar With PAN After Due Date

The late fees applicable on linking Aadhaar with PAN are as follows:

Date | Late Fees |

Till 31st March, 2022 | Rs. 0 |

1st April, 2022 – 30th June, 2022 | Rs. 500 |

After 30th June, 2022 | Rs. 1000 |

Perquisites For Linking Aadhaar With PAN

The linking of Aadhaar with PAN requires the following:

Firstly, valid PAN

Secondly, Aadhaar Number

Lastly, mobile number

How To Link Aadhaar With PAN (Where No Late Fees Is Applicable)?

As stated above, late fees are not applicable where the Aadhaar is linked with PAN within the due time i.e., till 31st March, 2022. Accordingly, in this case, there are two ways to link Aadhaar with PAN:

– Firstly, through Income Tax Portal

– Secondly, by sending an SMS to 567678 or 56161

How To Link Aadhaar With PAN After The Due Date?

Linking aadhaar with PAN after the due date attracts a penalty of Rs. 500 or Rs. 1000. Therefore, the person must first make payment of late fees on NSDL website.

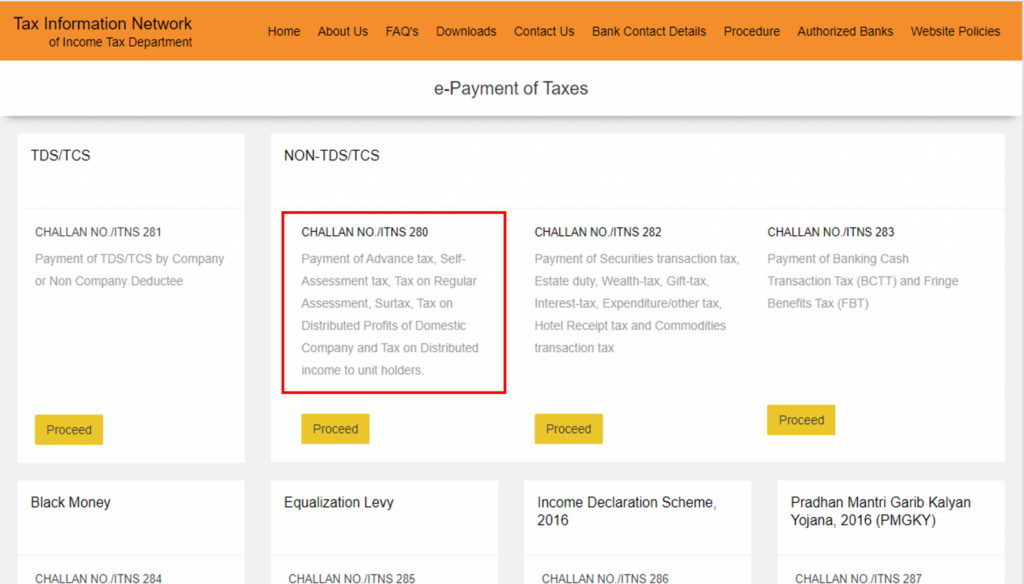

1. Visit the e-Payment for TIN (egov-nsdl.com) to pay the late fee Rs. 500 /1000 as the case may be.

2. Choose Challan no./ITNS 280 and click on proceed button.

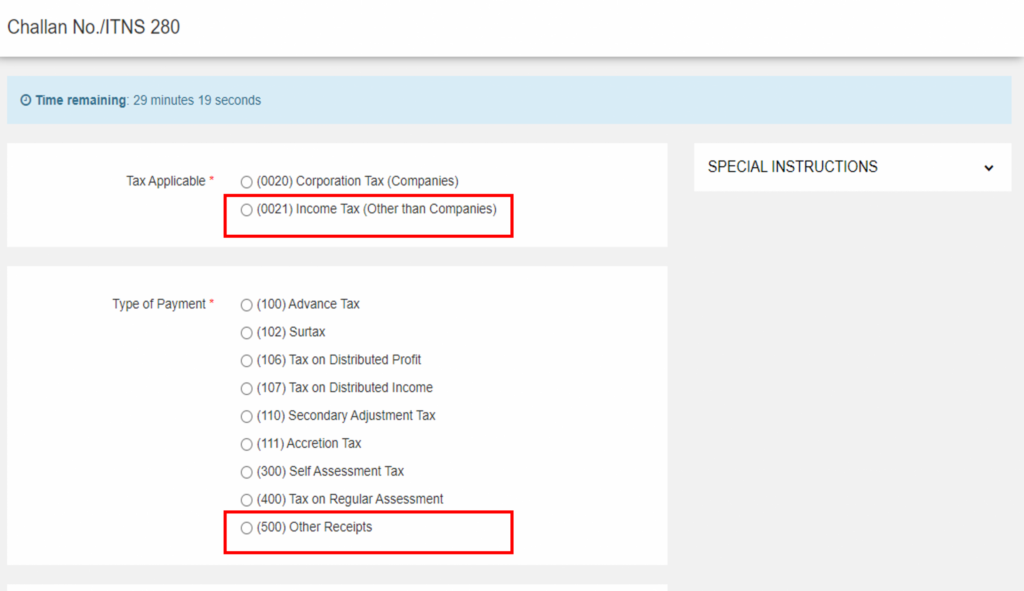

3. Thereafter, choose the option “[(0021) Income Tax (Other than Companies)]” and Type of Payment as “[(500) Other Receipts]”

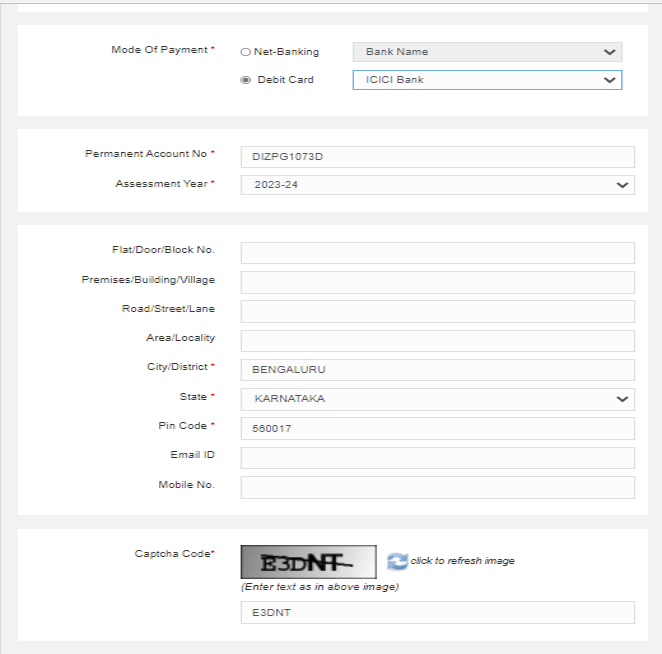

4. Now enter the mandatory details like Mode of Payment, Permanent Account No., Assessment Year, Address with City/District, State, Pincode as well as Captcha Code.

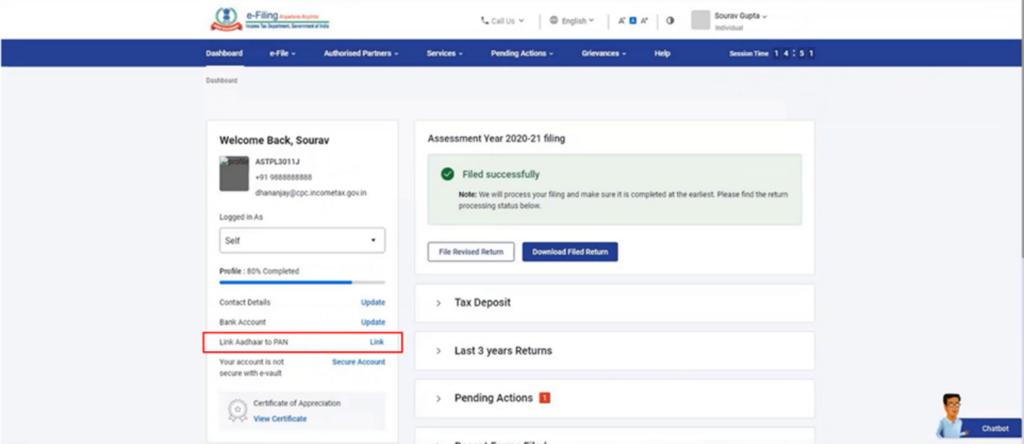

5. Thereafter, after making the payment on the NSDL website, head over to Income Tax Portal. Click on e-filing portal > Login > On Dashboard, under the Link Aadhaar to PAN option, click Link Aadhaar, or

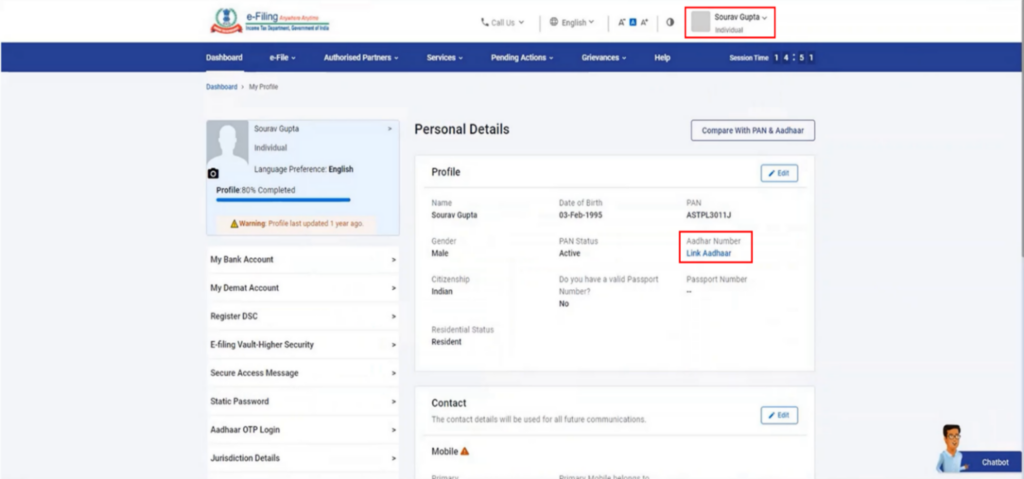

Alternatively, click on “Link Aadhaar” under the personal details section on logging on to the Income Tax Portal.

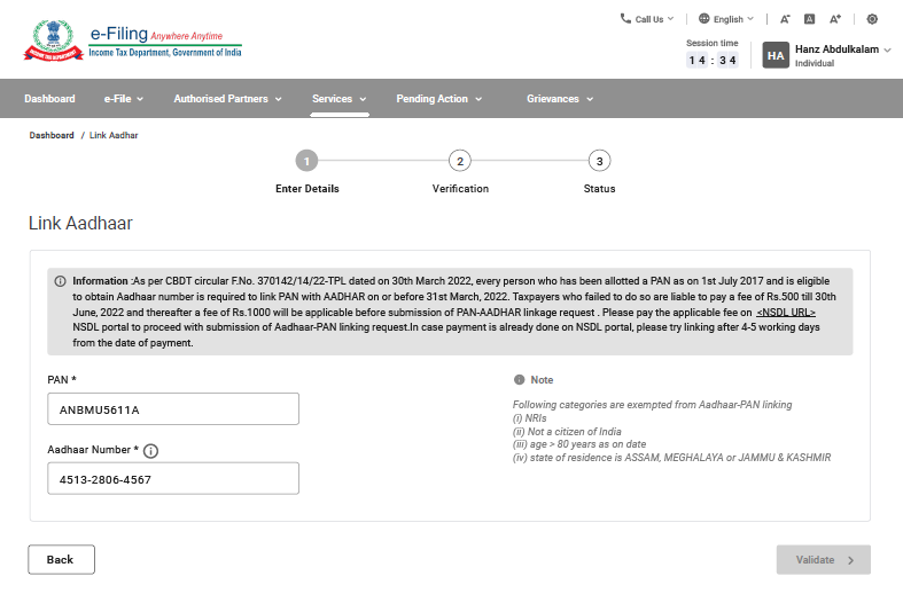

6. Consequently, enter your PAN and Aadhaar Number and click on “Validate”

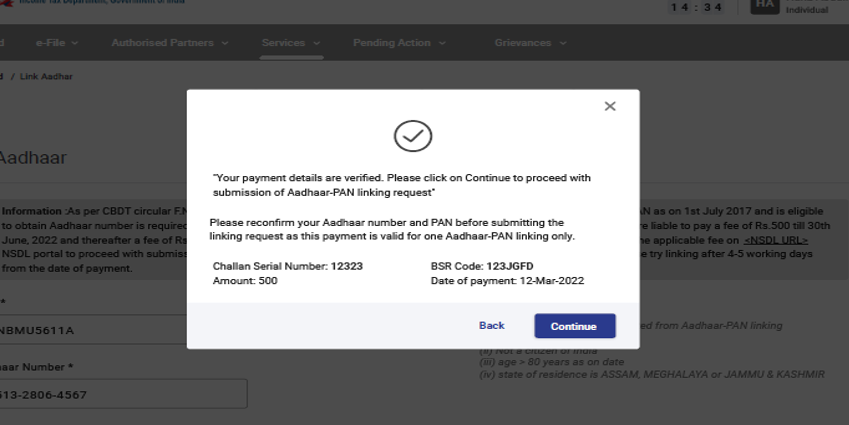

7. Now, if your challan payment of NSDL are verified by e-filing, a pop-up message will appear on your screen. The message will read as follows:

Click on “continue” to initiate the further process.

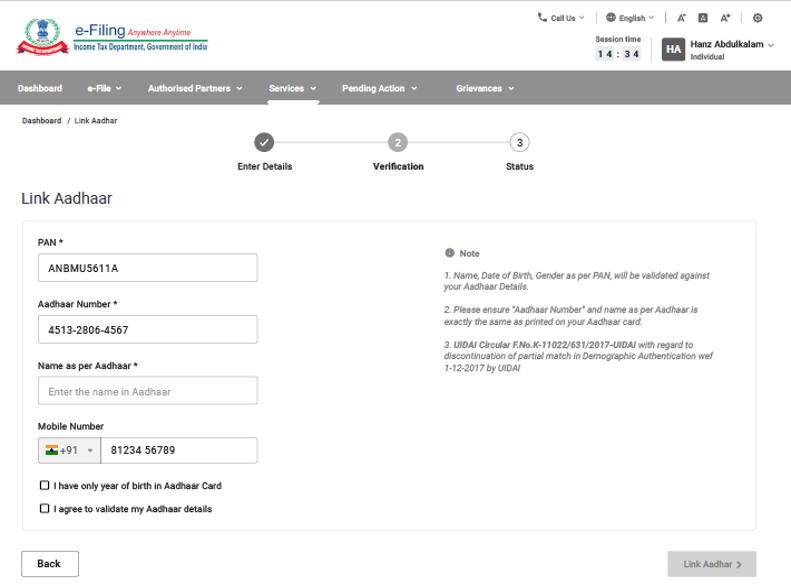

8. Thereafter, enter the mandatory details and click on “Link Aadhaar”

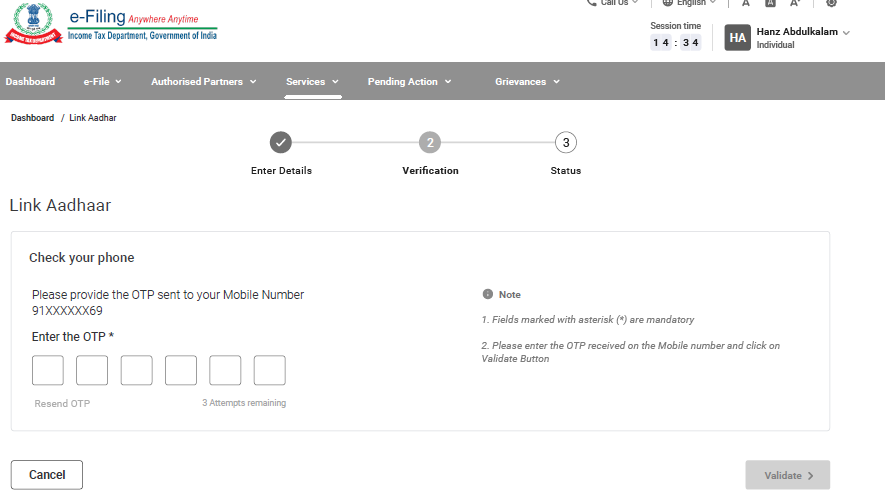

9. Enter the 6-digit OTP received on mobile no. mentioned in the previous step and click on “Validate”.

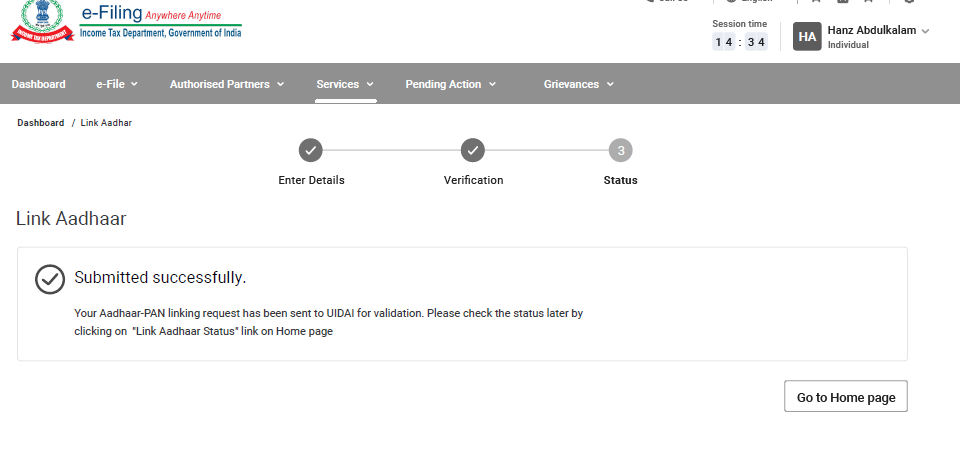

10. On successful submission, you can check the Aadhaar-PAN link status.