ITR-U is the Form used for updating your income tax return. The government introduced the concept of updated returns in the Union Budget 2022.

What is ITR-U?

Have you ever forgotten to report an income or made a mistake in your ITR?

Section 139(8A) under the Income Tax Act allows you a chance to update your ITR within two years. Two years will be calculated from the end of the year in which the original return was filed. ITR-U was introduced to optimise tax compliance by taxpayers without provoking legal action. Read on to learn more about ITR-U.

Who can file ITR-U?

Any person who has made an error or omitted certain income details in any of the following returns can file an updated return:

- Original return of income, or

- Belated return, or

- Revised return

An Updated Return can be filed in the following cases:

- Did not file the return. Missed return filing deadline and the belated return deadline

- Income is not declared correctly

- Chose wrong head of income

- Paid tax at the wrong rate

- To reduce the carried forward loss

- To reduce the unabsorbed depreciation

- To reduce the tax credit u/s 115JB/115JC

A taxpayer could file only one updated return for each assessment year(AY).

Who is not eligible to file ITR-U?

ITR-U cannot be filed in the following cases:

- Updated return is already filed

- For filing nil return/ loss return

- For claiming/enhancing the refund amount.

- When updated return results in lower tax liability

- Search proceeding u/s 132 has been initiated against you

- A survey is conducted u/s 133A

- Books, documents or assets are seized or called for by the Income Tax authorities u/s 132A.

- If assessment/reassessment/revision/re-computation is pending or completed.

- If there is no additional tax outgo (when the tax liability is adjusted with TDS credit/ losses and you do not have any additional tax liability, you cannot file an Updated ITR)

What is the time limit to file ITR-U?

The time limit for filing ITR-U is 24 months from the end of the relevant assessment year.

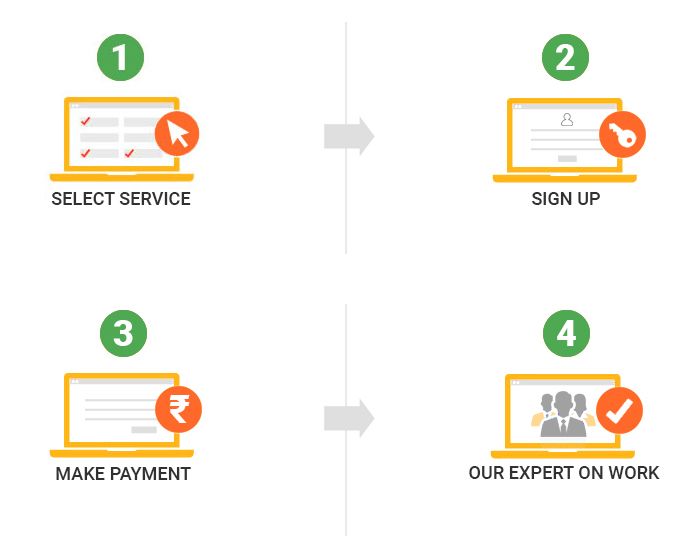

ITR-U

Should you pay additional tax when filing ITR-U?

Yes, you will have to pay an additional tax of 25% or 50% on the tax amount, depending on when you file the ITR-U.

| ITR-U filed within | Additional Tax |

| 12 months from the end of relevant AY | 25% of additional tax + interest |

| 24 months from the end of relevant AY | 50% of additional tax + interest |