How to Change The Authorised Signatory on The GST Portal

Follow the step-by-step guide mentioned below to successfully change the Authorised Signatory on the GST Portal:

Step 1: Log in to the GST portal.

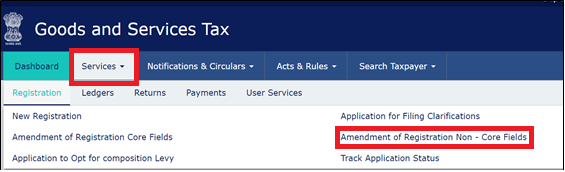

Step 2: Navigate to Services -> Registration -> Amendment of Registration Non-core Fields.

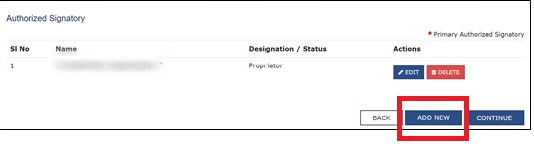

Step 3: Various tabs for editing data will be displayed on the screen. A taxpayer should click on the Authorised Signatory tab.

On clicking on the Authorised Signatory tab, the current Authorised Signatory will be displayed on the screen. A taxpayer can click on the ‘Add New’ option to add the new details.

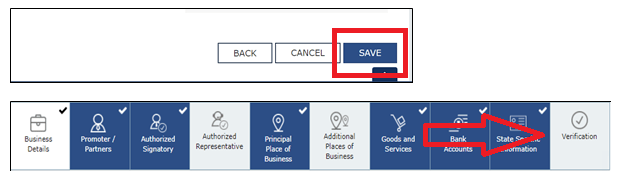

Step 4: Add the authorised signatory whose email ID and mobile number a taxpayer wants to use and fill in all the other details as applicable. Click on the ‘Save’ option.

Step 5: Click on the verification tab.

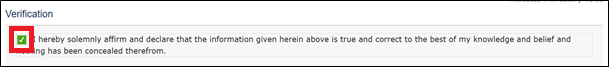

- Select the verification checkbox.

- Select the name of the authorised signatory from the drop-down list.

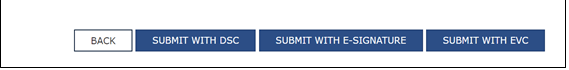

- Enter the place and select the option for digitally signing the application (Either DSC or EVC).

Step 6: On successful submission of the application, a message will be displayed on the screen stating ‘Successful Submission’. An acknowledgement will be sent on the old email address and mobile number within 15 minutes.

Step 7: After receiving the acknowledgement, log in to the GST portal and select the authorised signatory tab.

Step 8: Deselect the primary authorised signatory checkbox for the old signatory and select the newly added signatory as the primary authorised signatory.

Step 9: Verify the new email ID and mobile number for the newly added signatory.

Step 10: Select the verification tab again and apply by using DSC/EVC.

Step 11: On successful submission, an acknowledgement will be received on the new email address as well as a new mobile number.

Looking for GST Services? Click on the button below

You might be interested in:

How To Change The Registered Mobile Number or Email ID on The GST Portal

DSC – Usage, Documents Required, Pricing

Compliances and Fundraising Options – Society Registration