GST on Land & Building

GST regime considers selling of immovable property as supply of services. Therefore, GST is payable on the same. In this article, we shall talk in detail about GST on land and building.

GST On Land And Building (Real Estate)

Real estate comprises of land, buildings, flats and homes. Through the 33rd GST Council Meeting held on 24th February, 2019, some revisions were brought to the properties involved in real estate. These revised rates were recommended to take from 1st April, 2019. Having stated that, the ongoing projects will have an one time option to choose between the old and new GST rates.

👉 Read About: Section 80C Deductions: Available Even Without Any Investment!

Meaning Of Ongoing Projects

As per Para 2 of the Press Release dated 19th March 2019, ‘ongoing projects’ has been defined as:

“a. Building where ‘construction’ started before 01.04.2019 and b. Building where actual ‘booking’ started before 01.04.2019 and c. Building which have not been completed by 31.03.2019”

Example:

Case | Construction before 01.04.2019 | Booking before 01.04.2019 | Completion by 31.03.2019 | Option to avail old rates? |

I | Yes | Yes | No | Yes |

II | No | Yes | No | No |

III | Yes | No | No | No |

IV | Yes | Yes | Yes | No |

Applicability Of GST On Land

Under the GST regime, land is neither considered as supply of goods nor services. Therefore, no GST is applicable on buying and selling of land. On the purchase of land, however, stamp duty is to be paid by the buyer.

👉 Read About: TDS On Insurance Commission (Section 194D)

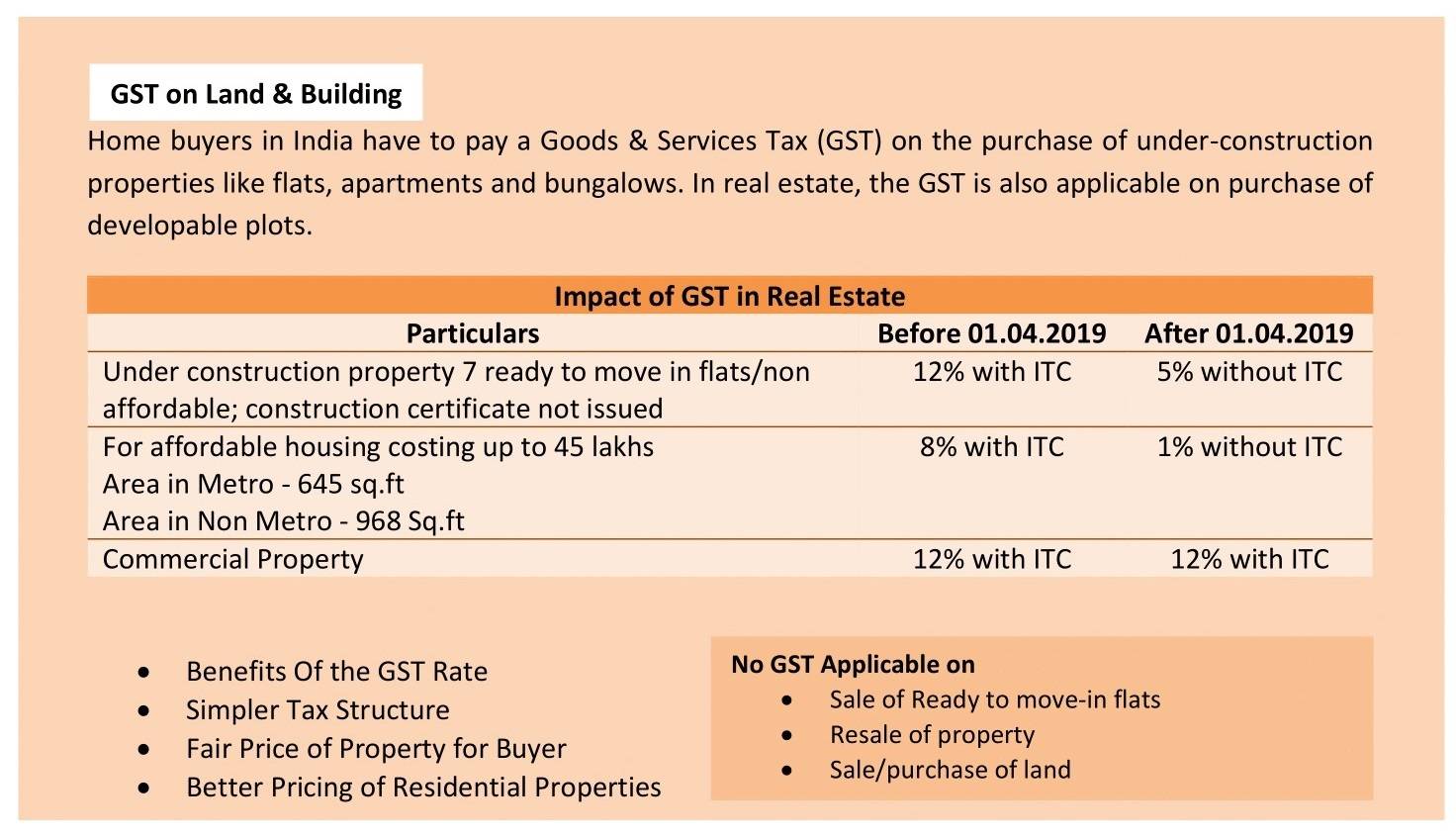

Building: GST Rates Applicable

In case of buildings, the property is charged tax under ‘work contracts’. Therefore, the developer cannot charge GST on the sale of ready to move-in buildings. On the other hand, if the building has been purchased for commercial purposes and is under construction, then GST would be applicable.

Building is said to be under construction when it is yet to receive its occupancy certificate.

Rates for GST on building held for commercial purposes are as follows:

Particulars | Before 01.04.2019 | After 01.04.2019 |

Commercial Property (shops, godowns, offices, etc) | 12% (with ITC) | 12% (with ITC) |

Treatment Of GST On Flat Purchase

The GST is applicable only on those flats which are under construction and the occupancy certificate has yet not been handed over to the buyer. Having stated that, no GST is applicable on ready to move in flats and flats meant for resale.

The GST rates applicable on flat purchase are as follows:

Particulars | Before 01.04.2019 | After 01.04.2019 |

Under construction properties and ready to move in flats/non affordable housing; construction certificate not issued | 12% (with ITC) | 5% (without ITC) |

For affordable housing costing upto Rs. 45 lacs | 8% with ITC | 1% (without ITC) |

Ready to move in flats | No GST is applicable | No GST is applicable |

Flats for resale | No GST is applicable | No GST is applicable |

Illustration: Comparison of GST on flats’ purchase in the affordable housing segment, before and after the change in rate in April 1, 2019:

|

Government Housing Schemes & GST

Government housing schemes just like the flats also attract GST. The housing schemes under Government includes the following:

- Jawaharlal Nehru National Urban Renewal Mission

- Rajiv Awas Yojana

- Pradhan Mantri Awas Yojana

- Housing schemes of state governments.

👉 Read About: Can You Claim HRA Even If You Own A House?

Rates of GST applicable for Government Housing Schemes are as follows:

Particulars | Before 01.04.2019 | After 01.04.2019 |

Under-construction home bought under the PMAY Credit-Linked Subsidy Scheme (CLSS) | 8% (with ITC) | 1% (without ITC) |

Under-construction home bought without the subsidy | 12% with ITC | 5% (without ITC) |

Works contract for affordable housing | 12% with ITC | 5% (without ITC) |

👉 Read About: Capital Gains On Sale Of House – All You Need To Know

Input Services Or Building Materials: GST

As stated earlier, real estate per se does not come under the purview of GST. But there are some activities and services in this sector which are taxable under the GST regime. The rates for input services which attracts GST are as follows:

Particulars | GST Rates |

Building bricks | 5% |

Crude Granite/Marble Rubble | 5% |

Fly Ash Blocks | 5% |

Roofing tiles | 5% |

Natural Sand (for construction) | 12% |

Refractory bricks/tiles | 12% |

Glass for construction purposes | 18% |

Prefabricated structural components for building | 18% |

Marble/Granite (other than blocks) | 18% |

Portland/Slag Cement | 28% |

👉 Read About: National Pension Scheme 80CCD(1B) – How To Claim ?

Maintenance Charges For Housing Societies And GST Applicable

GST is to be paid by the owners, if the maintenance charges for housing societies are Rs. 7,500 or more. Housing societies or Residents’ Welfare Associations (RWAs) that collect Rs 7,500 per month per flat, also have to pay 18% tax on the entire amount.

Housing societies which have an annual turnover of less than Rs 20 lakhs are, however, exempted from paying the GST.

Therefore, for the GST to be applicable, both the conditions should apply – i.e.,

- Each member should pay more than Rs 7,500 per month as maintenance charges and

- The annual turnover of the RWA should be more than Rs 20 lakhs (or Rs. 10 lakhs for special States).

Rent & GST

If the property has been rent out for the commercial purposes, then GST is applicable. On the other hand, if the property has been rent out for non commercial purposes (say renting a housing property), then no GST will be applicable

Particulars | GST Rates |

Rent on commercial property | 18% |

Rent on non commercial property | NIL |

Note: If the person who is getting more than Rs. 20 lakhs (or Rs. 10 lakhs for special States), then he is also required to obtain GST registration.

Is GST Levied On Home Loan?

There is no GST applicable on home loan repayment. However, the financial institutions providing the services of home loan, levy GST on processing fee, technical valuation fee and legal fee.

For GST Service (GST Registration & Return Filing, Click Here:

Book Service

Book Service

Book Service

Book Service